Hooks

in details

|

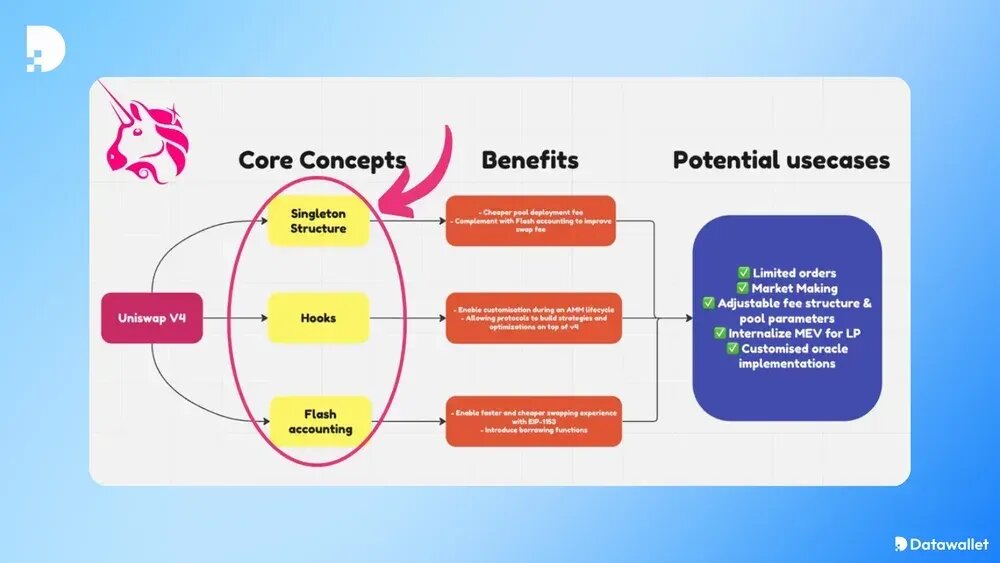

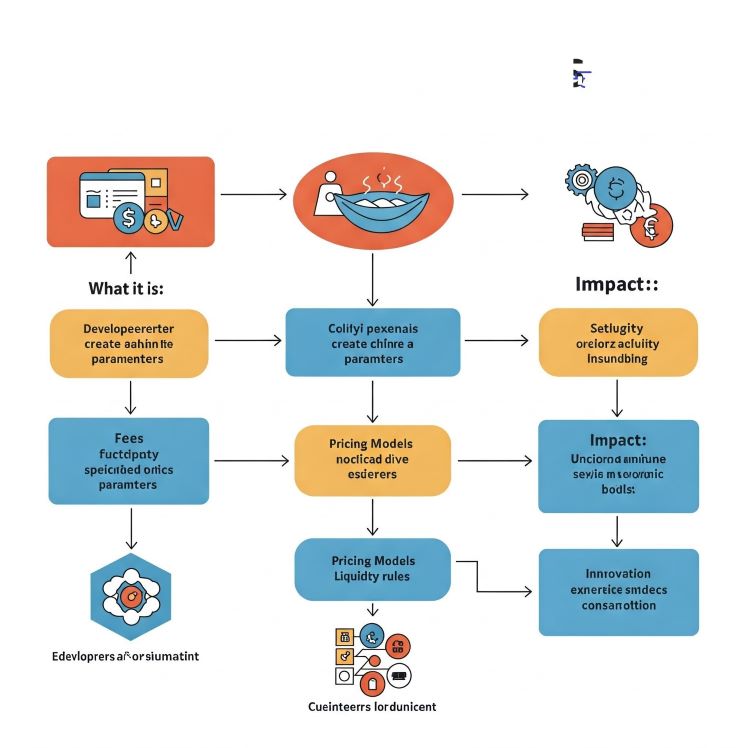

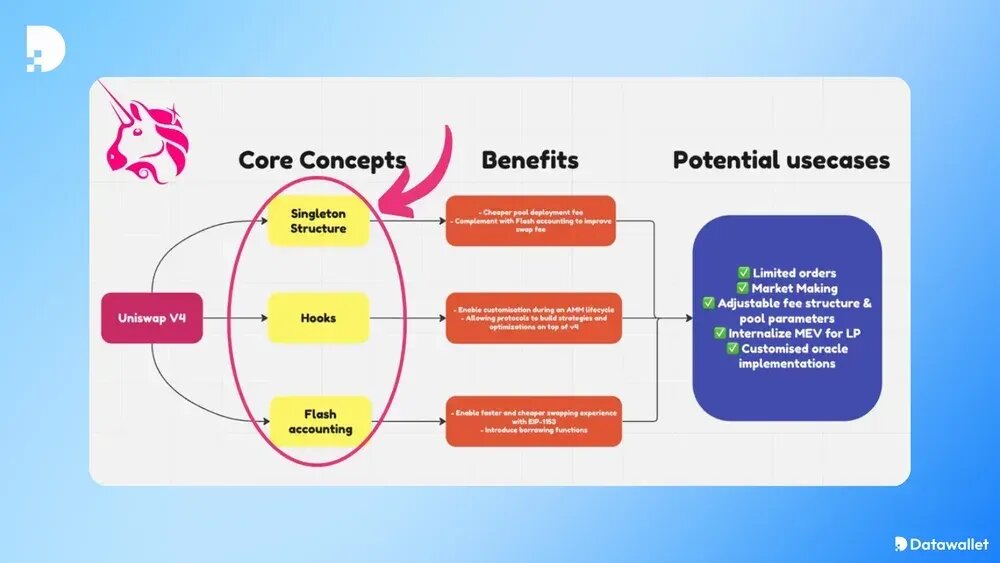

1. HOOKS are smart contract

plugins for Uniswap v4 pools.

2. They allow developers to customize pool behavior at key lifecycle

stages.

3. Hooks can execute code during actions like swaps, liquidity

provision, or fee adjustments.

4. Uniswap v4 introduces a modular architecture for hooks.

5. Developers deploy hooks as standalone smart contracts.

6. Hooks are attached to specific pools during their creation.

7. They enable features like dynamic fees, on-chain limit orders, or

TWAP (time-weighted average price) oracles.

8. Hooks can enforce custom rules for liquidity providers or traders.

9. They can integrate with external protocols for advanced DeFi use

cases.

10. Uniswap v4 uses a singleton contract model, reducing gas costs.

11. Hooks leverage callbacks to interact with the pool contract.

12. Developers can create permissionless or permissioned hooks.

13. Examples include auto-compounding rewards or MEV protection

mechanisms.

14. Hooks are written in Solidity, Ethereum's smart contract language.

15. They must adhere to Uniswap's interface specifications.

16. Testing hooks is critical to ensure security and efficiency.

17. Uniswap provides documentation and templates for hook development.

18. Hooks can be open-sourced or proprietary, depending on the

developer's goals.

19. They expand Uniswap's functionality without altering its core

protocol.

20. Hooks empower developers to innovate on DeFi's most popular DEX.

This innovation makes Uniswap v4 highly flexible, enabling developers

to build tailored solutions for diverse trading and liquidity

management needs.

Features

Interesting features that can be implemented with hooks.

Onchain limit orders that are filled at tick prices

Dynamic fees rooted in volatility or other determinants

Funneling out-of-range liquidity to lending platforms

Auto-composed LP fees re-integrated into LP positions

MEV profits being internally distributed back to liquidity providers

A TWAMM market maker with time-weighted averaging to execute large

orders over time

Creating custom onchain oracles (i.e. median, truncated) such as

geomean oracles

|